How Summitpath Llp can Save You Time, Stress, and Money.

Table of ContentsThe Only Guide to Summitpath Llp4 Simple Techniques For Summitpath LlpUnknown Facts About Summitpath LlpSummitpath Llp Fundamentals Explained

Most just recently, launched the CAS 2.0 Practice Advancement Coaching Program. https://www.find-us-here.com/businesses/SummitPath-LLP-Calgary-Alberta-Canada/34309676/. The multi-step training program consists of: Pre-coaching alignment Interactive team sessions Roundtable conversations Individualized training Action-oriented mini prepares Firms seeking to broaden into advisory solutions can likewise transform to Thomson Reuters Technique Ahead. This market-proven technique offers material, devices, and advice for firms thinking about advising servicesWhile the changes have opened a number of development possibilities, they have actually also resulted in challenges and concerns that today's firms need to have on their radars., firms should have the ability to quickly and efficiently carry out tax research and improve tax coverage effectiveness.

Additionally, the new disclosures might bring about a rise in non-GAAP actions, historically an issue that is highly scrutinized by the SEC." Accounting professionals have a lot on their plate from regulatory adjustments, to reimagined company designs, to a rise in client expectations. Equaling everything can be challenging, however it does not need to be.

Some Known Details About Summitpath Llp

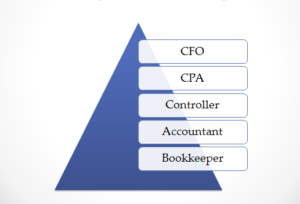

Listed below, we describe 4 CPA specializeds: tax, monitoring accounting, economic coverage, and forensic accounting. CPAs specializing in taxation assist their customers prepare and submit tax returns, minimize their tax burden, and avoid making mistakes that could result in costly penalties. All Certified public accountants need some knowledge of tax obligation legislation, however focusing on taxation implies this will certainly be the focus of your job.

Forensic accounting professionals generally start as basic accounting professionals and relocate right into forensic bookkeeping roles gradually. They need strong analytical, investigatory, business, and technological audit skills. CPAs who specialize in forensic accounting can in some cases go up into administration accountancy. Certified public accountants require at the very least a bachelor's degree in bookkeeping or a comparable field, and they have to finish 150 credit hours, consisting of accounting and business courses.

No states call for a graduate degree in accounting. Nevertheless, an audit master's degree can help students fulfill the certified public accountant education and learning requirement of 150 credit scores given that many bachelor's programs only call for 120 credit scores. Bookkeeping coursework covers topics like finance - https://www.find-us-here.com/businesses/SummitPath-LLP-Calgary-Alberta-Canada/34309676/, bookkeeping, and taxes. Since October 2024, Payscale reports that the ordinary annual wage for a CPA is $79,080. outsourcing bookkeeping.

Accountancy also makes practical feeling to me; it's not simply theoretical. The Certified public accountant is an essential credential to me, and I still get proceeding education credits every year to maintain up with our state needs.

How Summitpath Llp can Save You Time, Stress, and Money.

As a freelance specialist, I still utilize all the fundamental foundation of accountancy that I discovered in university, seeking my certified public accountant, and functioning in public accounting. Among the important things I truly like concerning accounting is that there are numerous various work offered. I determined that I wished to begin my job in public audit in order to discover a lot in a brief period of time and be exposed to different sorts of clients and different areas of accountancy.

"There are some work environments that don't want to consider a person for an accountancy role that is not a CPA." Jeanie Gorlovsky-Schepp, CPA A certified public accountant is an extremely valuable credential, and I wished to position myself well in the industry for various tasks - Bookkeeper Calgary. I made a decision in university as an audit major that I intended to attempt to obtain my CPA as soon as I could

I've satisfied lots of wonderful accounting professionals who don't have a CPA, yet in my experience, having the credential really aids to advertise your experience and makes a distinction in your settlement and career choices. There are some work environments that don't intend to consider somebody for an audit duty who is not a CERTIFIED PUBLIC ACCOUNTANT.

A Biased View of Summitpath Llp

I actually appreciated working on different types of jobs with different clients. In 2021, I made a decision to take the next step in my accountancy occupation trip, and I am now a freelance accountancy expert and service consultant.

It continues to be a development area for me. One important quality in being an effective certified public accountant is genuinely respecting your customers and their services. I like dealing with not-for-profit clients for that very reason I feel like I'm actually adding to their mission by aiding them have excellent financial details on which to make clever business decisions.

Comments on “A Biased View of Summitpath Llp”